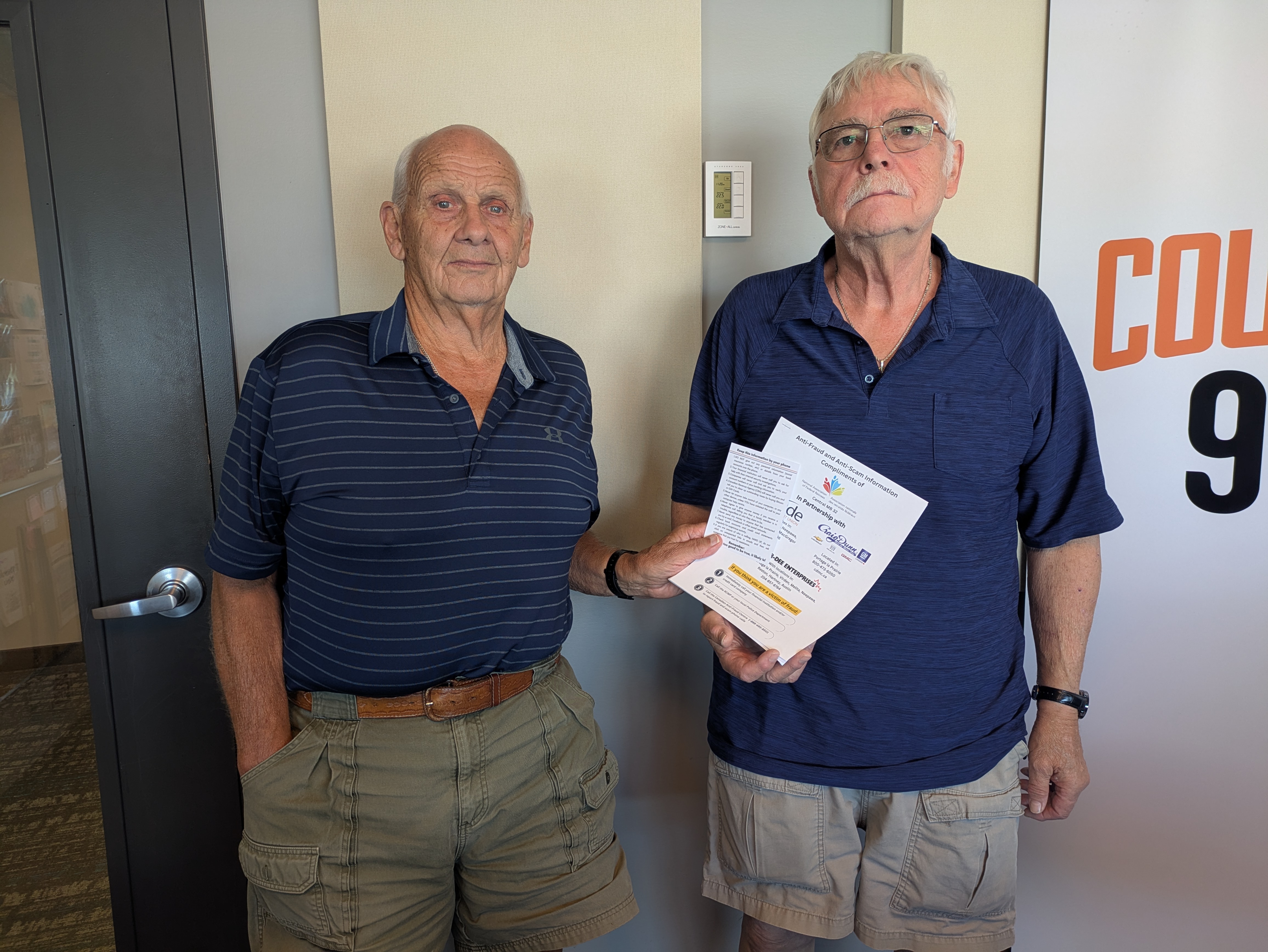

A pair of retired servicemen in Portage la Prairie are leading a grassroots effort to educate seniors about fraud prevention. The program, which began in March 2024, was created by retired RCMP officer Colin Wilcox and Canadian Armed Forces veteran Glen Jones, president of the local branch of the National Association of Federal Retirees.

It grew out of a board meeting where members discussed scams targeting seniors," says Wilcox.

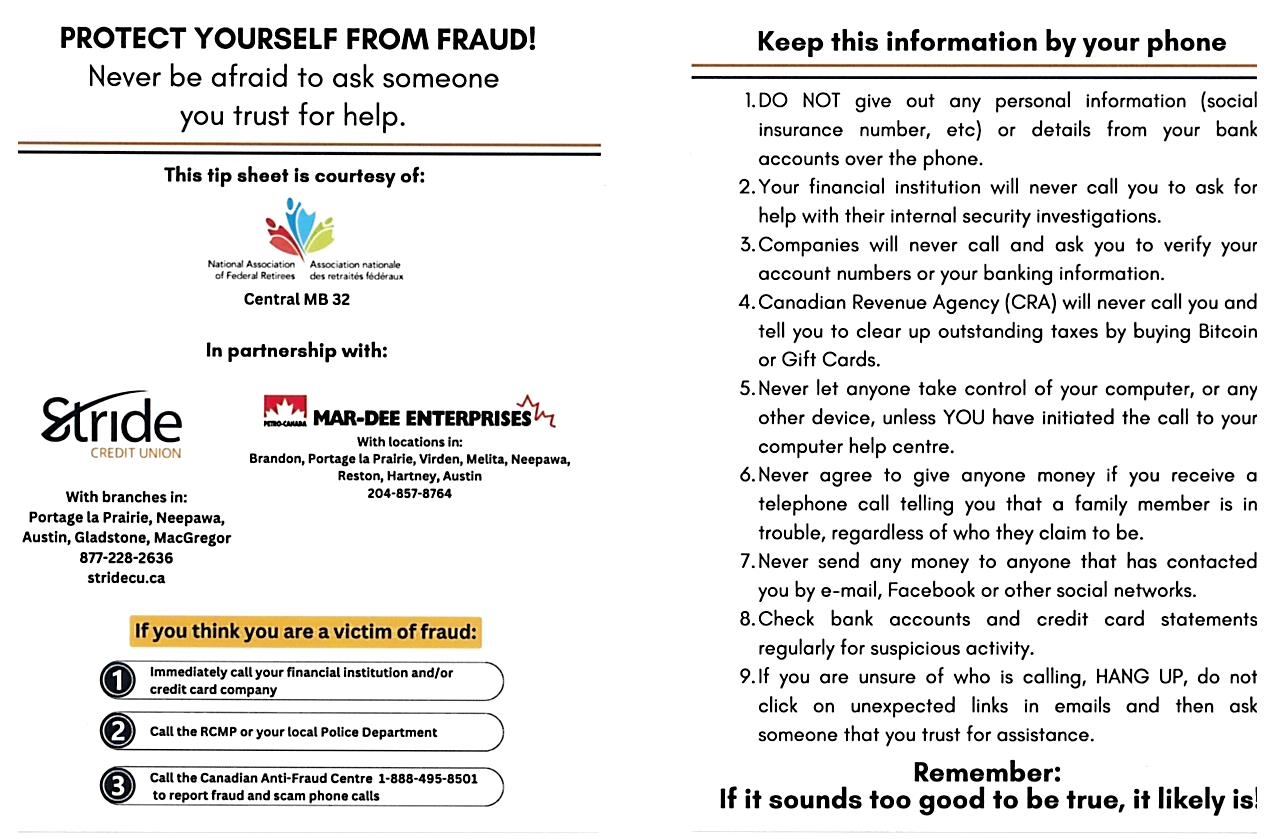

Soon after, Wilcox approached Mayor Sharilyn Knox for information and teamed up with Jones to produce pamphlets outlining common frauds. With support from Stride Credit Union, Petro-Canada, and local businesses, they were able to distribute hundreds of copies across senior housing complexes and community centres.

Wilcox notes, "Between Glen and I, we went to Stride Credit Union. They wanted to get involved, they had a pamphlet. So, we combined the two of them. And a friend of mine at Petro-Can said, ‘What do you want to do with this?’ I said I’d like to put a pamphlet in all the apartments that the seniors are in. So, just to bring some information, he said, 'Well, you need about 500 copies.' So he put up the money for 500 copies.”

The pair have since printed additional runs, expanded their materials to include laminated “pointer cards” with quick tips, and given dozens of presentations in Portage la Prairie and neighbouring communities.

Educating seniors across Manitoba

Glen Jones explains that the local Retirees’ branch covers an area stretching from north of Gladstone to the U.S. border, and from MacGregor to Headingley. The National Association, founded in 1960, now represents more than 174,000 members across Canada.

Jones says, “After hearing and seeing the sharp increase in scams and fraud in our community and across Canada, our board decided to start educating the members of our branch and members of our community about anti-fraud and scam prevention.”

He adds that corporate sponsors such as Stride Credit Union, Craig Dunn Motor City, and Mar-Dee Enterprises have been instrumental in covering printing costs. Stride Credit Union has also pledged to help anyone who suspects they are a victim of fraud, regardless of whether they are a member.

To date, the team has delivered about 20 presentations to seniors’ groups and non-profits, reaching several hundred people in communities from Portage to Pine Falls. They have also shared their material with branches across the country, which have started running similar sessions.

Sharing stories and strategies

Wilcox says the presentations have revealed heartbreaking examples of fraud. He recalls one woman in Gladstone who lost $7,500 to a scammer posing as a friend. He also cites the so-called “grandparent scam,” where callers pretend a grandchild is in jail and pressure seniors to send money.

Wilcox adds, “If somebody phoned you and says your grandchild is in jail, then the correct response is, 'I hope they feed him well,' and hang up the phone.”

Feedback from participants has reinforced the importance of the work. Many victims have chosen to share their experiences publicly so that others can learn to recognize scams and avoid them.

The mechanics of modern scams

Jones notes that many scams now begin with a computer-generated phone call. The pause before a live voice answers is often the telltale sign.

Jones continues, “When you pick up the phone and there’s a pause, there’ll be a two or three-second pause. Then you’ll hear somebody on the other end. You can almost rest assured that’s a computer-generated phone call. My advice is if you get one of these, hang up, look up the agency’s number yourself, and call that instead. Never call the number they give you.”

Both men warn that scammers are highly sophisticated, often imitating government agencies or banks, and sometimes even arranging in-person visits. They emphasize that no legitimate organization will ever demand payment in gift cards.

Prevention is the best defence

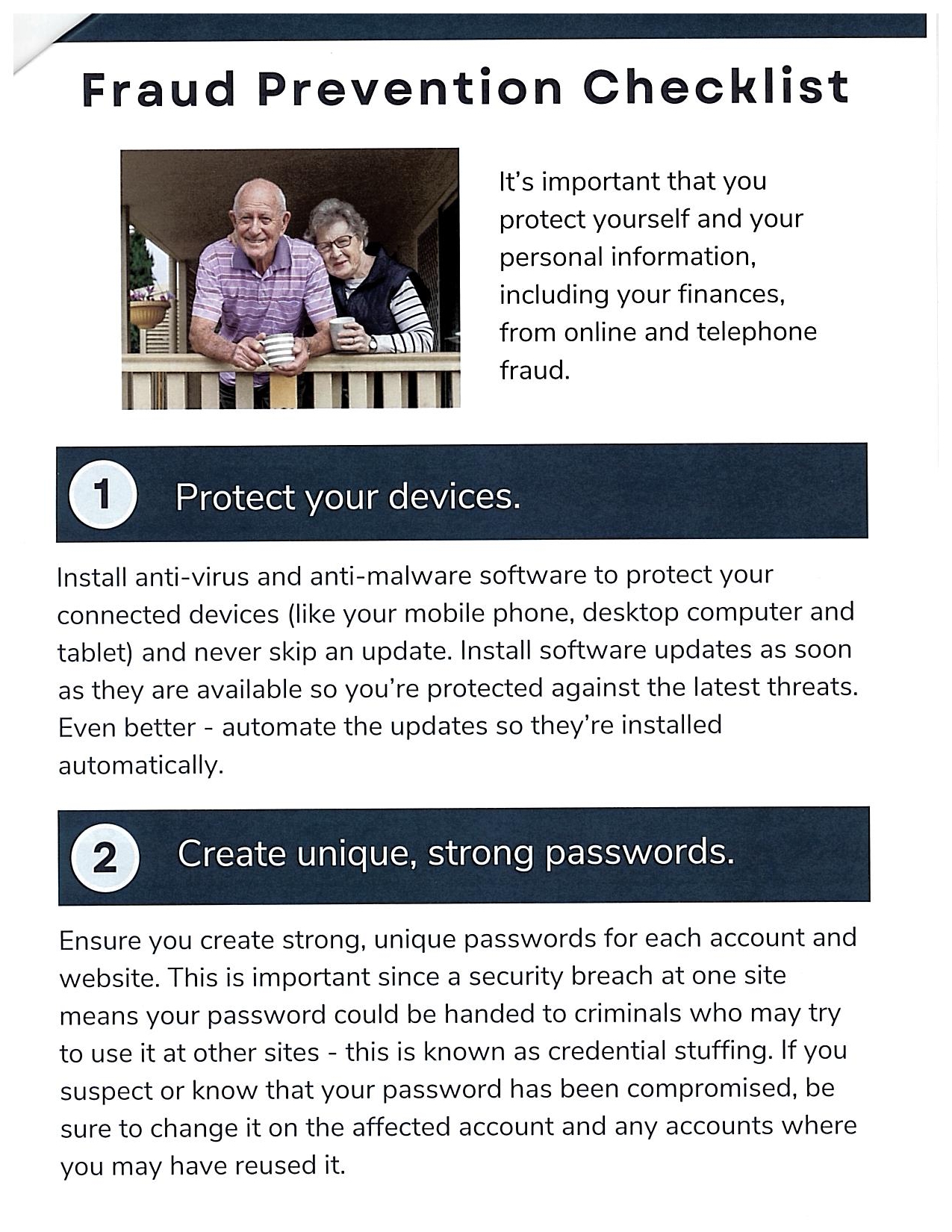

The group has introduced anti-scam telephones with call-filtering features and distributed more than 1,600 laminated pointer cards for seniors to keep by their phones. They stress that prevention is the only reliable protection, since fraud schemes constantly evolve.

Wilcox says, “If we can help somebody from not getting ripped off by the scams, we’ll do it. And this is why we’re providing this information.”

The response has been overwhelmingly positive, with requests for more presentations and materials continuing to come in. Both men say they are motivated not only by concern for their peers, but also by a desire to protect future generations.

Jones adds, “Frauds and scams are always evolving. The basic scam is always the same, but they will use different tactics and methods to gain your trust and try to take your money. It’s your money. Don’t be giving it away.”

Looking ahead

The retirees are continuing to seek support from corporate partners, while exploring opportunities for additional funding. They point to the federal New Horizons for Seniors program, which offers up to $25,000 for community projects, as a potential source of future support for their initiative.

In the meantime, they plan to keep presenting, printing, and spreading the word, one community at a time.

To book a presentation, you can reach Glen Jones at (204) 856-3642 and Colin Wilcox at (204) 870-305 or (204) 857-3655.

Sign up to get the latest local news headlines delivered directly to your inbox every afternoon.

Send your news tips, story ideas, pictures, and videos to news@portageonline.com.

PortageOnline encourages you to get your news directly from your trusted source by bookmarking this page and downloading the PortageOnline app.

Click the Audio PLAY button below the hear the full interview packed with tips and scam awareness information: