Today, the Honourable Heath MacDonald, Minister of Agriculture and Agri-Food, announced the initial list of regions that will qualify for the Livestock Tax Deferral in 2025.

The Livestock Tax Deferral provision allows livestock producers in prescribed areas, who are forced to sell all or part of their breeding herd due to drought, excess moisture or flooding, to defer a portion of their income from sales until the following tax year. The income may be at least partially offset by the cost of reacquiring breeding animals, thus reducing the tax burden associated with the original sale.

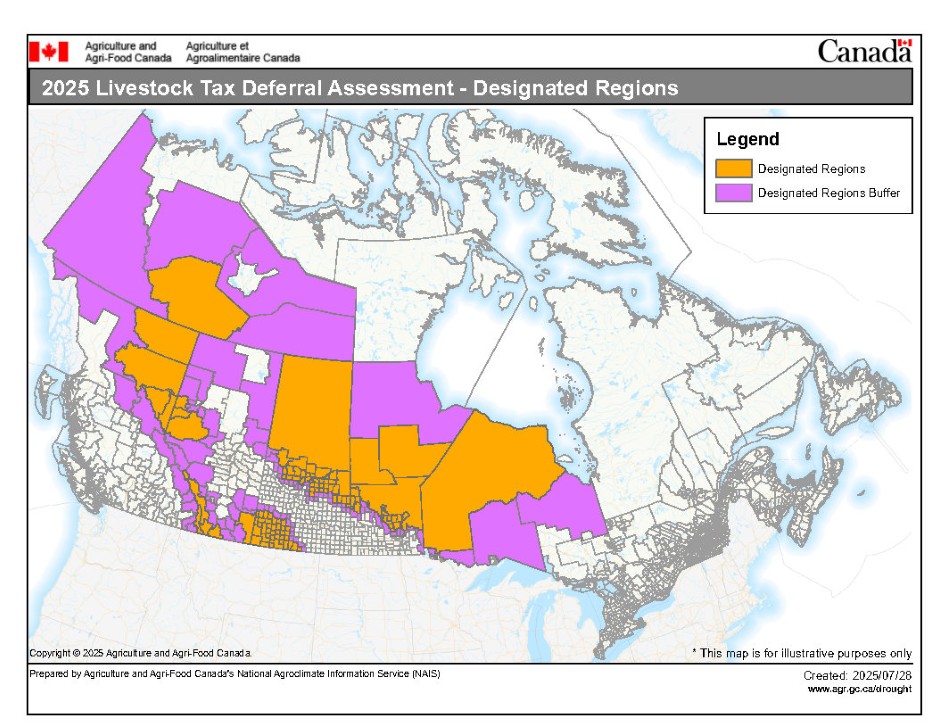

Buffer zones have been applied to capture impacted producers who are outside the boundaries of the prescribed regions but may be experiencing similar conditions. Weather, climate and production data from across Canada will continue to be monitored throughout the remainder of the season and regions will be added to the list when they meet the criteria.

Livestock Tax Deferral serves as an important instrument for farmers to mitigate the financial burden of drought, excess moisture or flooding. The Government of Canada will continue to work to ensure farmers receive timely information to support their herd management decisions.

- To defer income under the Livestock Tax Deferral provision, the breeding herd must have been reduced by at least 15%.

- In the case of consecutive years of drought, excess moisture or flooding, producers may defer sales income to the first year in which the region is no longer prescribed.

- Subsequent regions will be added to the list when they meet the eligibility criteria of forage shortfalls of 50% or more caused by drought, excess moisture or flooding.

- Producers have access to a comprehensive suite of business risk management (BRM) programs to help them manage significant risks that threaten the viability of their farm and are beyond their capacity to manage. BRM programs, including AgriStability, AgriInsurance and AgriInvest, are the first line of defense for producers facing disasters and farmers are encouraged to make use of these programs to protect their farming operation.

- For the 2025 program year, the compensation rate for AgriStability will be increased from 80% to 90% and the maximum payment limit will be increased from $3 million to $6 million.

To see the complete list of Livestock Tax Deferral areas identified in 2025 click here.